YourFMO ACA Basics

ACA Marketplace Network Types

Health insurance plan & network types: HMOs, PPOs, and more

There are different types of Marketplace health insurance plans designed to meet different needs. Some types of plans restrict your provider choices or encourage you to get care from the plan’s network of doctors, hospitals, pharmacies, and other medical service providers. Others pay a greater share of costs for providers outside the plan’s network.

Types of Marketplace plans

Depending on how many plans are offered in your area, you may find plans of all or any of these types at each metal level – Bronze, Silver, Gold, and Platinum.

Some examples of plan types you’ll find in the Marketplace:

Exclusive Provider Organization (EPO): A managed care plan where services are covered only if you use doctors, specialists, or hospitals in the plan’s network (except in an emergency).

Health Maintenance Organization (HMO): A type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the HMO. It generally won’t cover out-of-network care except in an emergency. An HMO may require you to live or work in its service area to be eligible for coverage. HMOs often provide integrated care and focus on prevention and wellness.

Point of Service (POS): A type of plan where you pay less if you use doctors, hospitals, and other health care providers that belong to the plan’s network. POS plans require you to get a referral from your primary care doctor in order to see a specialist.

Preferred Provider Organization (PPO): A type of health plan where you pay less if you use providers in the plan’s network. You can use doctors, hospitals, and providers outside of the network without a referral for an additional cost.

(Source: https://www.healthcare.gov/choose-a-plan/plan-types/ )

ACA Marketplace Plan Types

The health plan categories: Bronze, Silver, Gold & Platinum

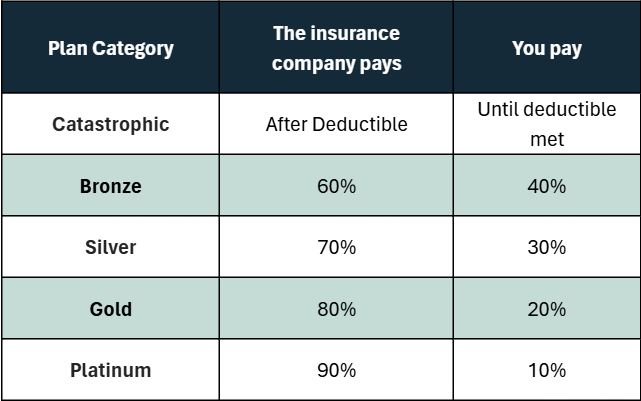

Plans in the Marketplace are presented in 4 health plan categories: Bronze, Silver, Gold, and Platinum. (“Catastrophic” plans are also available to some people.)

How you and your insurance plan split costs

Estimated averages for a typical population. Your costs will vary.

Bronze

- Lowest monthly premium

- Highest costs when you need care

- Bronze plan deductibles — the amount of medical costs you pay yourself before your insurance plan starts to pay — can be thousands of dollars a year.

- Good choice if: You want a low-cost way to protect yourself from worst-case medical scenarios, like serious sickness or injury. Your monthly premium will be low, but you’ll have to pay for most routine care yourself.

Silver

- Moderate monthly premium

- Moderate costs when you need care

- Silver deductibles — the costs you pay yourself before your plan pays anything — are usually lower than those of Bronze plans.

Notice:

Getting extra savings with a Silver plan

- If you qualify for cost-sharing reductions: You must pick a Silver plan to get the extra savings. You can save hundreds or even thousands of dollars per year if you go to the doctor a lot. (Silver plans may also be available if you’re eligible for a premium tax credit and can enroll through a Special Enrollment Period based on estimated household income.)

- If you’re enrolled in a Silver plan and lose your cost-sharing reductions: You’ll qualify for a Special Enrollment Period. If you want to change plans, you can enroll in a Bronze, Silver or Gold plan that meets your needs and fits your budget.

- Good choice if: You qualify for “extra savings” — or, if not, if you’re willing to pay a slightly higher monthly premium than Bronze to have more of your routine care covered.

Gold

- High monthly premium

- Low costs when you need care

- Deductibles — the amount of medical costs you pay yourself before your plan pays — are usually low.

- Good choice if: You’re willing to pay more each month to have more costs covered when you get medical treatment. If you use a lot of care, a Gold plan could be a good value.

Platinum

- Highest monthly premium

- Lowest costs when you get care

- Deductibles are very low, meaning your plan starts paying its share earlier than for other categories of plans.

- Good choice if: You usually use a lot of care and are willing to pay a high monthly premium, knowing nearly all other costs will be covered.

Find out how to use total costs of care to pick a category and plan that work for you.

Note: Plans in all categories provide free preventive care, and some offer selected free or discounted services before you meet your deductible.

(Source: https://www.healthcare.gov/choose-a-plan/plans-categories/#:~:text=Plans%20in%20the%20Marketplace%20are,also%20available%20to%20some%20people )

10 Essential Health Benefits Under ACA

What Marketplace health insurance plans cover

All plans offered in the Marketplace cover these 10 essential health benefits:

- Ambulatory patient services (outpatient care you get without being admitted to a hospital)

- Emergency services

- Hospitalization (like surgery and overnight stays)

- Pregnancy, maternity, and newborn care (both before and after birth)

- Mental health and substance use disorder services, including behavioral health treatment (this includes counseling and psychotherapy)

- Prescription drugs

- Rehabilitative and habilitative services and devices (services and devices to help people with injuries, disabilities, or chronic conditions gain or recover mental and physical skills)

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care (but adult dental and vision coverage aren’t essential health benefits)

Additional benefits

Plans must also include the following benefits:

- Birth control coverage

- Breastfeeding coverage

Essential health benefits are minimum requirements for all Marketplace plans. Specific services covered in each broad benefit category can vary based on your state’s requirements. Plans may offer additional benefits, including:

- Dental coverage

- Vision coverage

- Medical management programs (for specific needs like weight management, back pain, and diabetes)

When comparing plans, you’ll see exactly what each plan offers.

(Source: https://www.healthcare.gov/coverage/what-marketplace-plans-cover/ )

OEP Dates

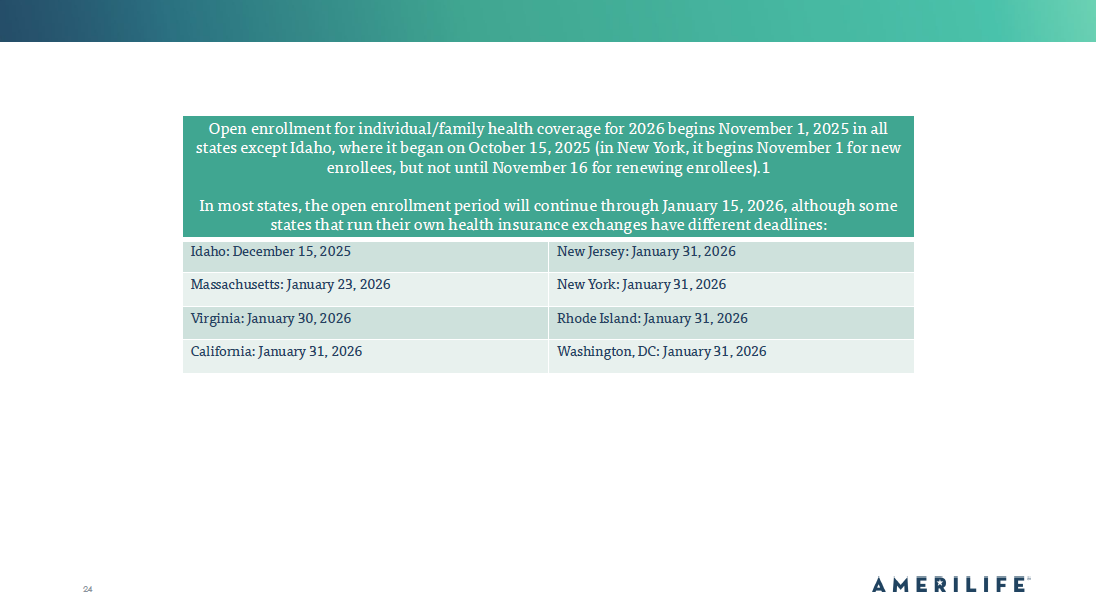

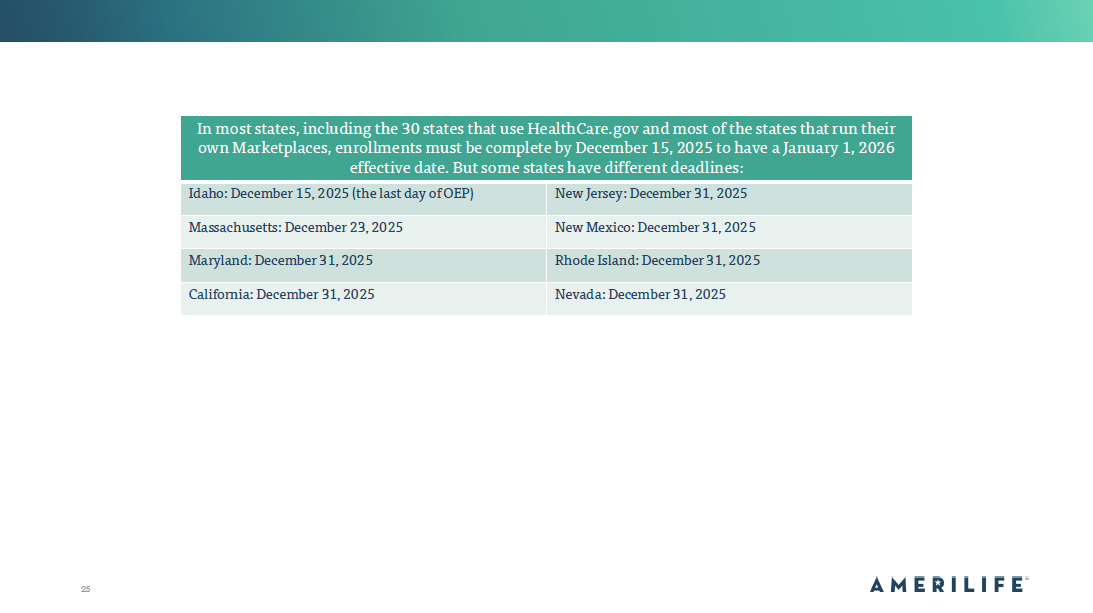

Open Enrollment Period – OEP

The yearly period when people can enroll in a health insurance plan. Most of these state-run exchanges follow a November 1 – January 15 schedule. Some opted to add a one-day extension to account for the federal holiday on January 15, while others did not. However, some state-run exchanges have different enrollment windows. See below for a list of those states

SEP (Special Enrollment Period)

Special Enrollment Period (SEP)-A qualifying life event that allows consumers to enroll in Major Medical/ACA compliant Insurance outside of OEP. This is NOT a comprehensive list.

What are some qualifying life events?

- Marriage or divorce

- The birth or adoption of a child

- The loss of employer-based health insurance coverage

- Moving to a new city outside of old plan’s coverage area

- Changes in income that may make client eligible for subsidies* (Most Common)

*In September 2021, the U.S. Department of Health & Human Services finalized a new special enrollment period (SEP) in states that use HealthCare.gov (optional for other states), granting year-round enrollment in ACA-compliant health insurance if an applicant’s household income does not exceed 150% of the federal poverty level (FPL) and if the applicant is eligible for a premium tax credit (subsidy) that will cover the cost of the benchmark plan.

This SEP is currently slated to run through 2025 (or longer, if the American Rescue Plan’s subsidy enhancements are extended), but the government has proposed a rule change that would make it permanently available.

(Source: https://www.healthcare.gov/coverage-outside-open-enrollment/special-enrollment-period/ )

What is a Subsidy?

Subsidized Plans: What are they?

Health coverage available at reduced or no cost for people with incomes below certain levels.

Examples of subsidized coverage include Medicaid and the Children’s Health Insurance Program (CHIP). Marketplace insurance plans with premium tax credits are sometimes known as subsidized coverage too. For purposes of the premium tax credit, your household income is your modified adjusted gross income for the year plus that of every other member of your family who is required to file a federal income tax return.

- In states that have expanded Medicaid coverage, your household income must be below 138% of the federal poverty level (FPL) to qualify.

- In all states, your household income must be between 100% and 400% FPL to qualify for a premium tax credit that can lower your insurance costs.

- If your income is at or below 150% FPL, you may qualify to enroll in or change Marketplace coverage through a Special Enrollment Period.

- If your income is above 400% FPL, you may still qualify for savings on a 2024 Marketplace health insurance plan.

- Households with income above 400% of FPL are eligible for subsidies through 2025 if the cost of the benchmark plan would otherwise be more than 8.5% of the household’s income.

Is there a cap on how much I have to pay back? Yes. If your 2024 household income is less than 400% of the 2024 federal poverty level,

Below chart is the maximum amount of excess APTC (Advance Premium Tax Credit) you’ll have to repay:

Cost-sharing Reductions Explained

CSR: Cost-sharing reductions

After you fill out an application with the Marketplace and provide household and income information, you’ll find out if you qualify for the premium tax credit that lowers your monthly health insurance bill.

You’ll also find out if your income qualifies you for extra savings known as “cost-sharing reductions.” If it does, you will receive a discount that lowers the amount you have to pay for deductibles, copayments, and coinsurance.

Getting extra savings with a Silver plan

- If you qualify for cost-sharing reductions: You must pick a plan in the Silver category to get these extra savings on out-of-pocket costs.

- If you enroll in a plan in another health plan category, you can still use the tax credit. But, you won’t get these extra savings.

- Silver plans may also be available if you’re eligible for the tax credit and can enroll through a Special Enrollment Period based on estimated household income.

If you’re enrolled in a Silver plan and lose your cost-sharing reductions: You’ll qualify for a Special Enrollment Period. If you want to change plans, you can enroll in a Bronze, Silver or Gold plan that meets your needs and fits your budget.

(Source: https://www.healthcare.gov/lower-costs/save-on-out-of-pocket-costs/ )